Table of Contents

District Budget

Code 01 ............... Certificate Page – shows adopted budget, expenditures and tax to be levied, and computation of

delinquency

Code 02 ............... Resolutions for levy limits for tax funds (capital outlay, adult ed, historical museum, recreation

commission)

Code 04 ............... Worksheet showing tax levy (motor vehicle, recreational vehicle, delinquency, estimates)

Code 05 ............... Statement of Indebtedness (bond and interest – bonds issued, interest and principle)

Code 05a ............. Statement of conditional lease, lease purchase and certificate of participation (payments and int.)

Code 06 ............... General Fund – Unencumbered cash balance; Revenue (local, county, state and federal)

General Fund – Expenditures such as salaries, benefits, textbooks, supplies, operations and

maintenance, etc.

Code 07 ............... Federal Funds – Unencumbered cash balance; Revenue - federal grants such as Title I, II, III, IV,

V, VI, VIB

Federal Funds – Expenditures such as salaries, benefits, textbooks, supplies, purchased services,

etc.

Code 08 ............... Supplemental General (Local Option Budget) Revenue (local, county, state); tax levied

Supplemental General (Local Option Budget) Expenditures such as salaries, supplies, equipment,

repairs and maintenance, communication services, and transfers to other funds

Code 11 ............... At Risk 4yr Old – Revenue (local, federal)

At Risk 4yr Old – Expenditures such as salaries, benefits, textbooks and supplies

Code 13 ............... At Risk K-12 – Revenue (local, federal)

At Risk K-12 – Expenditures such as salaries, benefits, textbooks, and supplies

Code 14 ............... Bilingual Education – Revenue (local, federal)

Bilingual Education – Expenditures such as salaries, purchased services, and supplies

Code 15 ............... Virtual Education – Revenue (local)

Virtual Education – Expenditures such as salaries, benefits, textbooks, software and supplies

Code 16 ............... Capital Outlay – Revenue [local, county, federal (impact aid construction)]

Capital Outlay – Expenditures – equipment and furnishings, buses, property, repair and

remodeling, etc.

Code 18 ............... Driver Training – Revenue (local, state)

Driver Training – Expenditures such as salaries, supplies, equipment, etc.

Code 24 ............... Food Service – Revenue (local, state, federal)

Food Service – Expenditures such as salaries, energy, supplies (food and milk), equipment, etc.

Code 26 ............... Professional Development – Revenue (local, state, federal), and expenditures for support services,

salaries, supplies, equipment, etc.

Code 28 ............... Parent Education – Revenue (local, state)

Parent Education – Expenditures such as salaries, benefits, supplies, staff training, etc.

Code 29 ............... Summer School – Revenue (local, federal)

Summer School – instruction, salaries, supplies, equipment, energy, etc.

Code 30 ............... Special Education – Revenue (local, state, federal)

Special Education – Expenditures such as salaries, purchased services, property, supplies,

equipment, student transportation, etc.

Code 34 ............... Vocational Education – Revenue (local, federal)

Vocational Education – Expenditures such as salaries, purchased services, supplies, and equipment

Code 51 ............... KPERS – Revenue (state); Expenditures such as employee benefits

Code 53 ............... Contingency Reserve – Revenue (transfer from general)

Contingency Reserve – Expenditures such as salaries, supplies, equipment, property services, etc.

Code 55 ............... Textbook & Student Material Revolving – Revenue (local) and expenditures for textbooks,

musical equipment, materials and supplies, etc.

Code 56 ............... Activity Fund – Revenue (Local Sources)

Activity Fund – Expenditures such as referees, supplies, activity equipment, etc.

Code 62 ............... Bond and Interest (USD) #1 – Revenue (local, county, state) and expenditures for principle and

interest

Table of Contents cont.

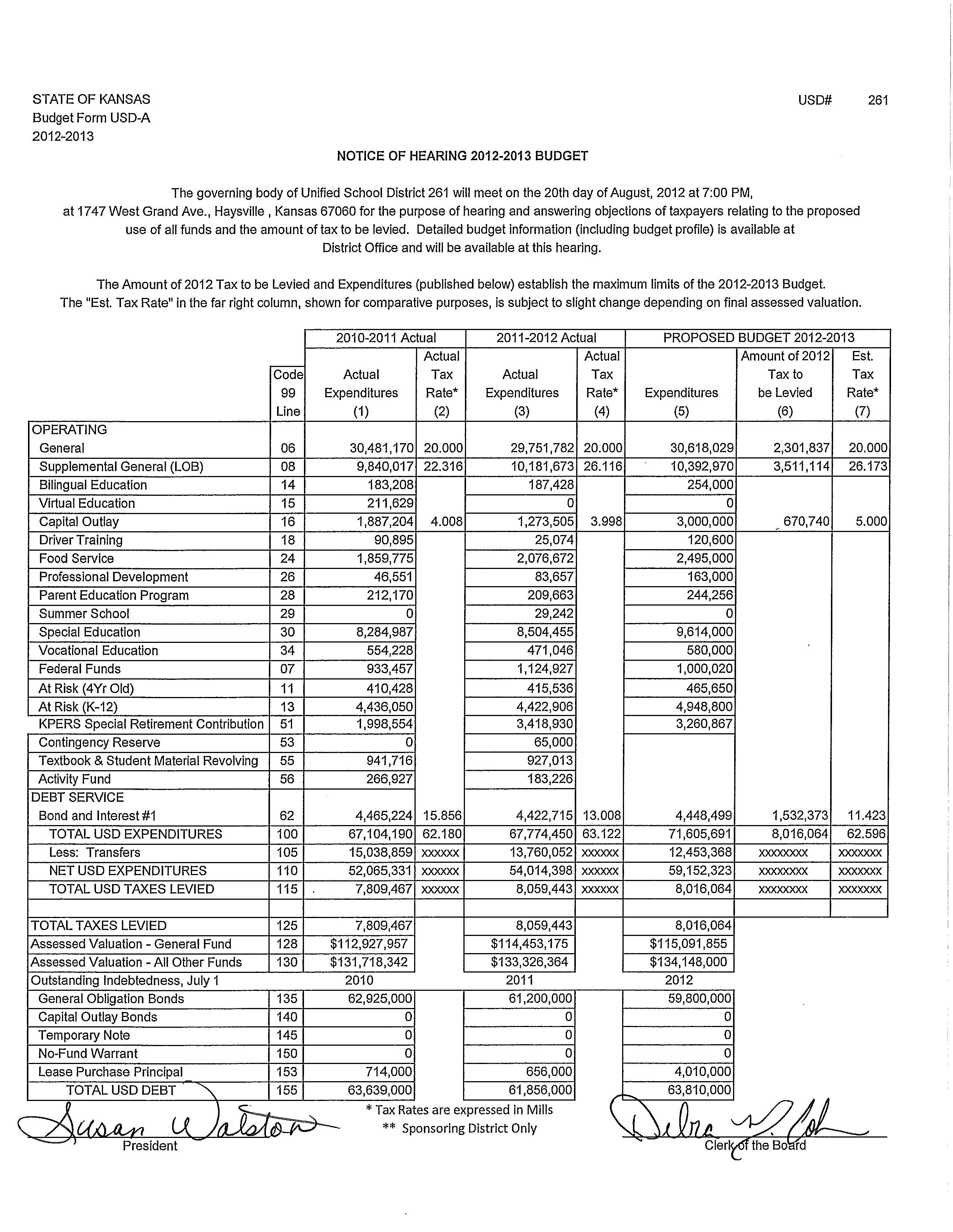

Code 99 ............... Notice of Hearing (published in newspaper) is a summary showing operating funds and total

expenditures, special education cooperative, total taxes levied and estimated tax rate. Other line

items include library board, recreation commission, assessed valuation, lease purchase principle,

and total USD debt.

Average Salary .............. This page provides FTE and average salaries for administrators, teachers, licensed personnel, and

substitutes.

Budget Authority and Revenue Worksheets

Form 110

Tax in Process

Form 118

Estimated Special Education Revenue

Form 148

Estimated General Fund State Aid

Form 149

Transfer Cash Balances to General Fund

Form 150

Estimated Legal Maximum Budget

Form 155

Local Option Budget

Form 162

Estimated Food Service Revenue

Form 194

Estimated Motor Vehicle Taxes

Form 195

Estimated State Aids (Professional Development, Driver Ed, and KPERS Flow-Through)

Form 239

Estimated Supplemental General State Aid

Form 241

Estimated Bond & Interest State Aid Payments (Prior to 7/92)

Form 242

Estimated Bond & Interest State Aid Payments (After 7/92)

Budget Profile

Page 1 ................. Budget general information: general information about the community, contact information for

board members, names of key staff (administrators, business office and board clerk), and

Page 2 ................. District accomplishments and challenges

Page 3-7 .............. Supplemental information for tables in Summary of Expenditures

Page 8-9 .............. KSDE and USD 261 website information available

•

K-12 statistics (building, district or state totals for attendance, enrollment, staff,

graduates/dropouts, crime/violence)

•

School Finance reports and publications (certified personnel, enrollment, dropouts, graduates,

salary reports)

•

Kansas Building Report Card (rates for attendance, graduation, dropouts, school violence;

reading, math and writing assessments for all districts)

•

Website Information available on the USD 261 website

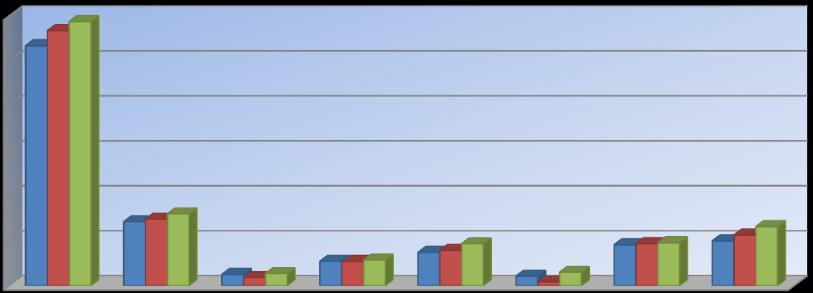

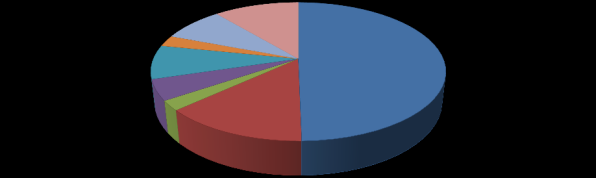

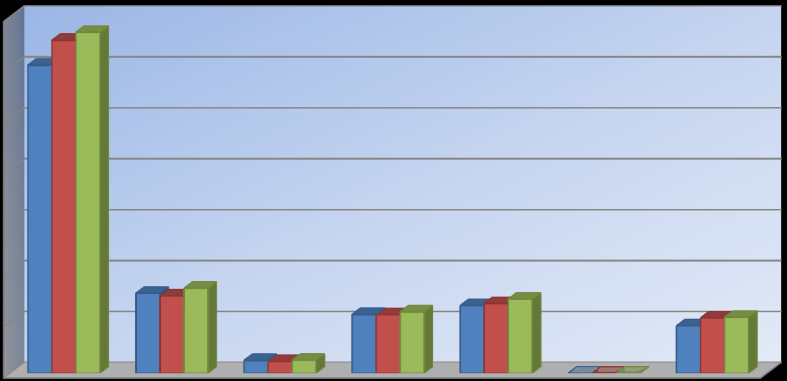

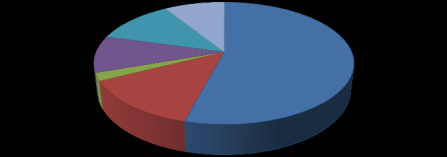

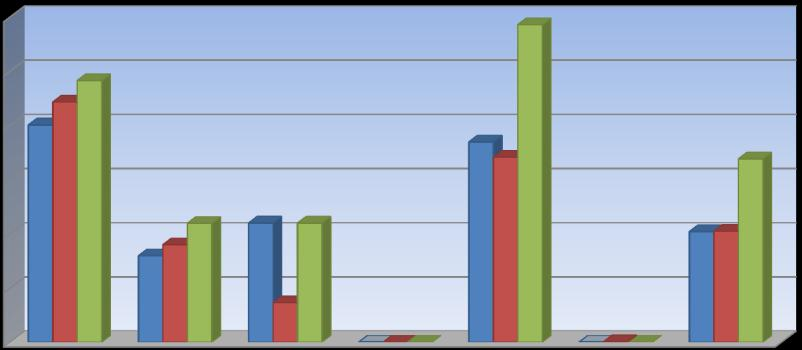

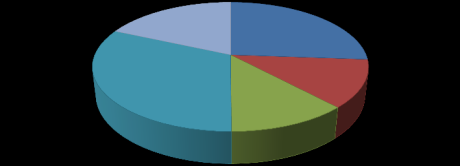

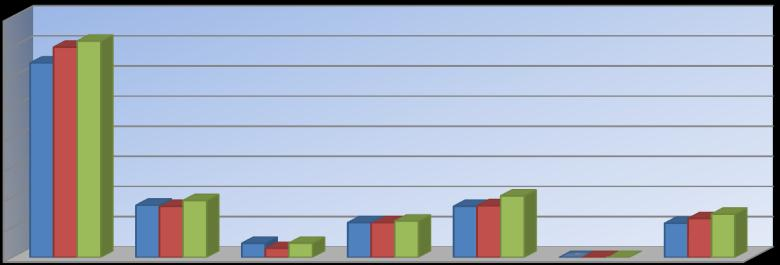

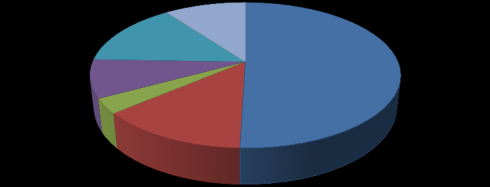

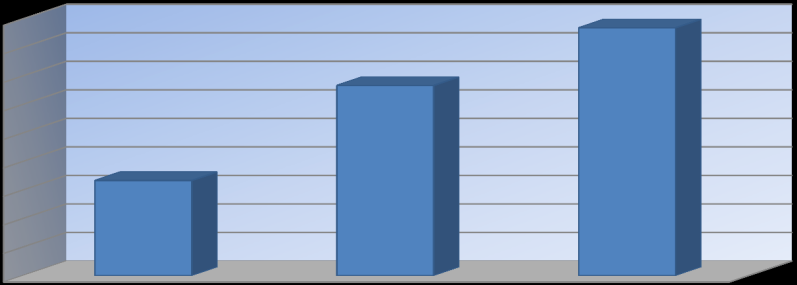

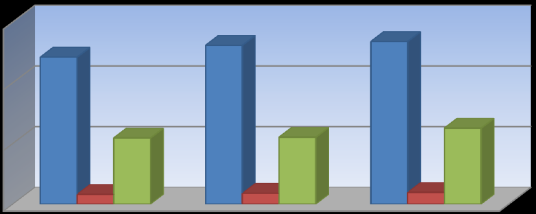

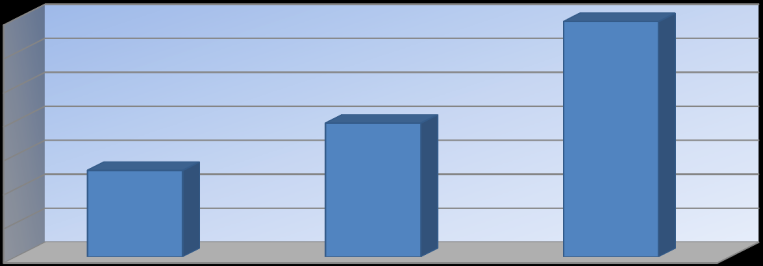

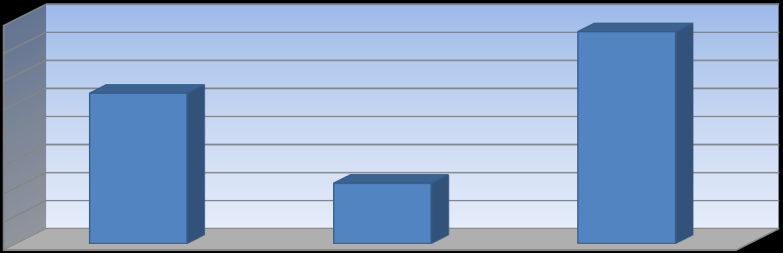

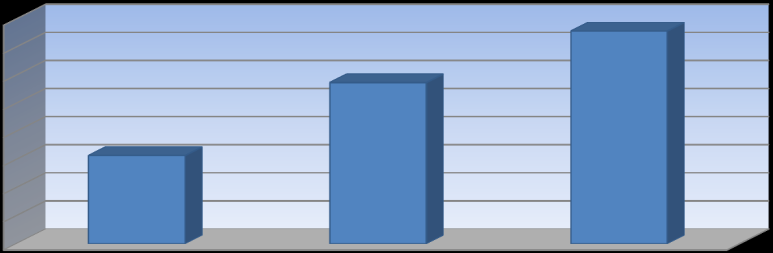

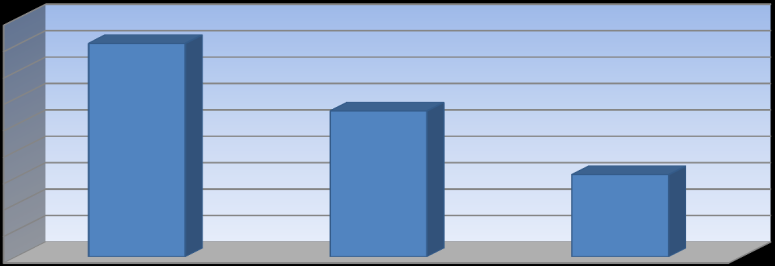

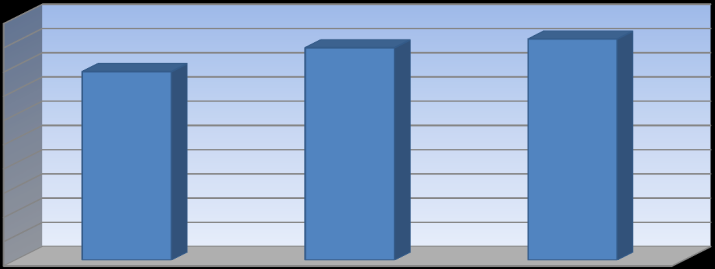

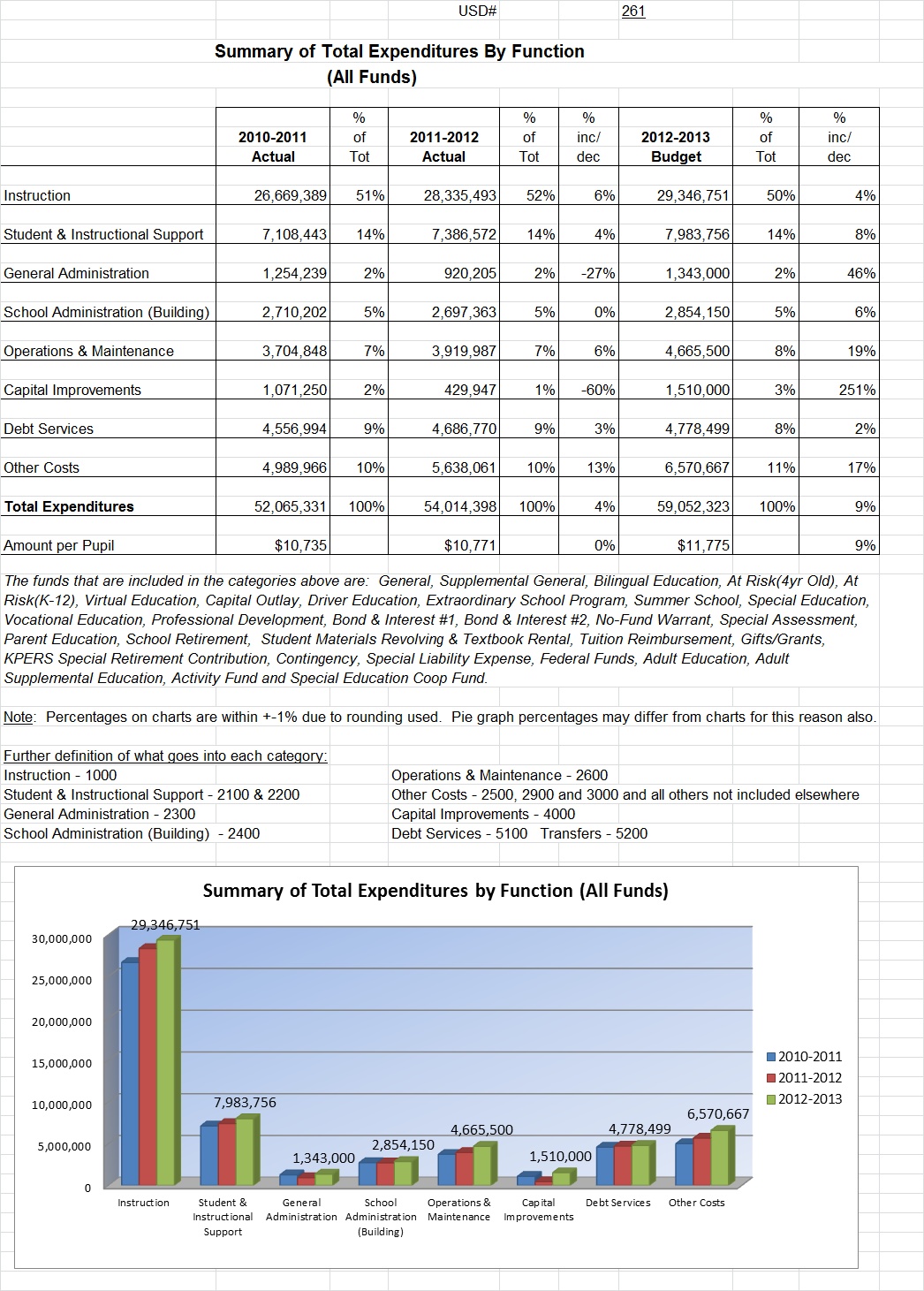

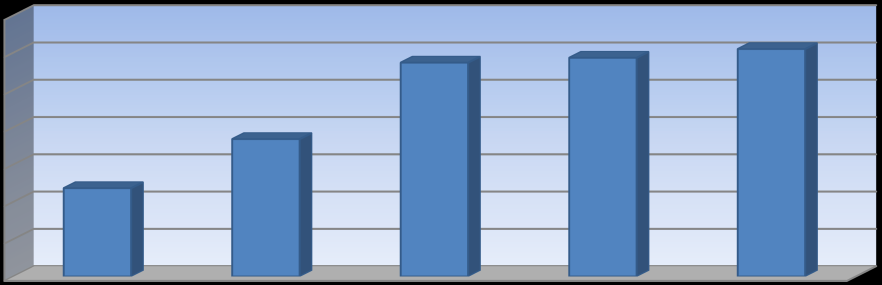

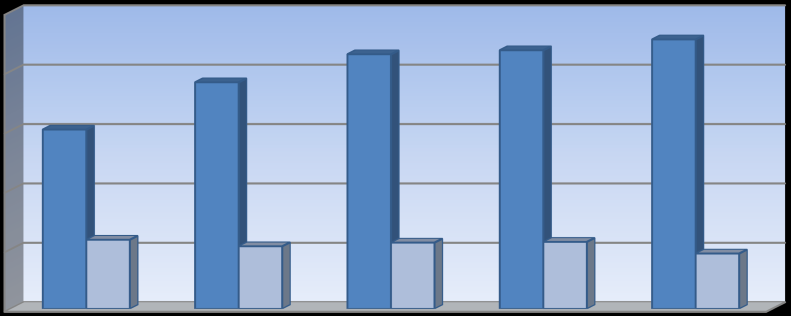

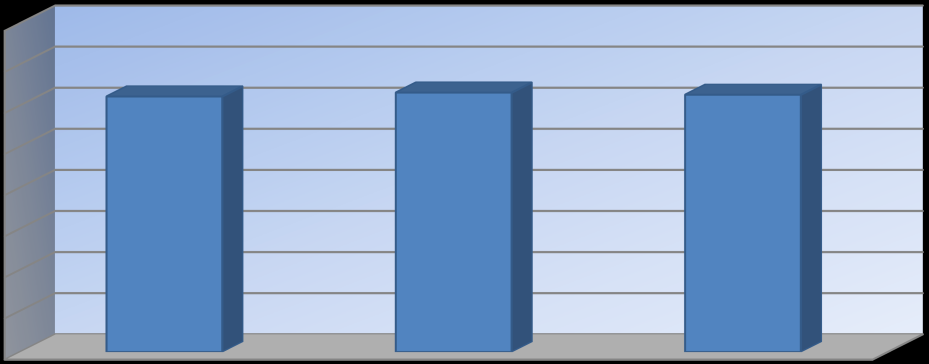

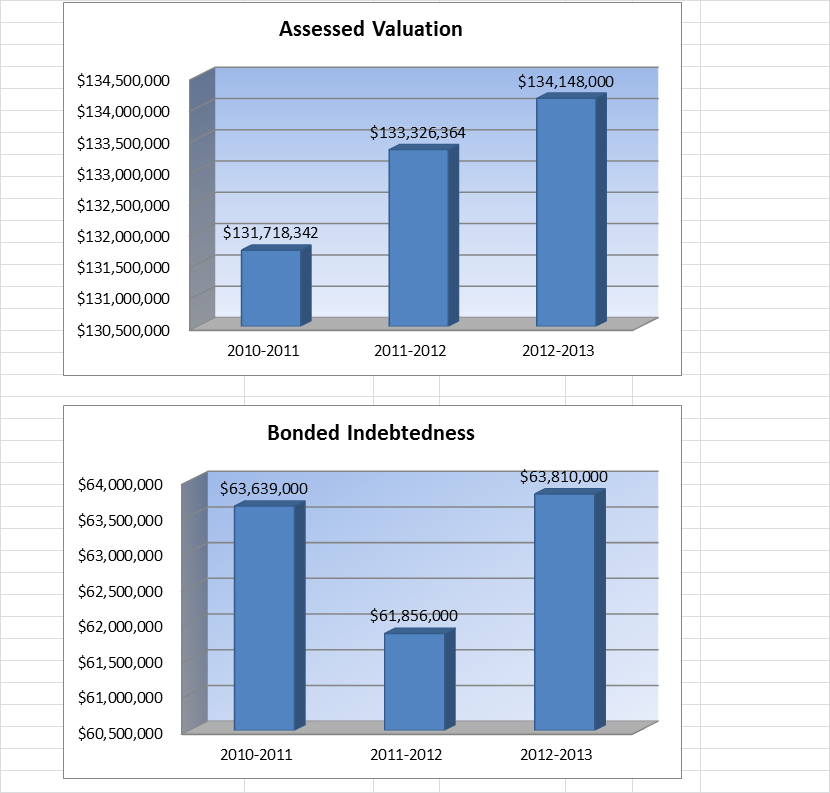

Summary of expenditures (sumexpen.xls) – Tables and graphs illustrate a 3-year comparison of expenditures by

function, FTE enrollment, low income students, mill rates by fund, assessed valuation and bonded indebtedness.

Budget At A Glance

Page 3 ................. Summary of Total Expenditures by function (all funds)

Page 4 ................. Summary of General and Supplemental General Fund Expenditures by Function

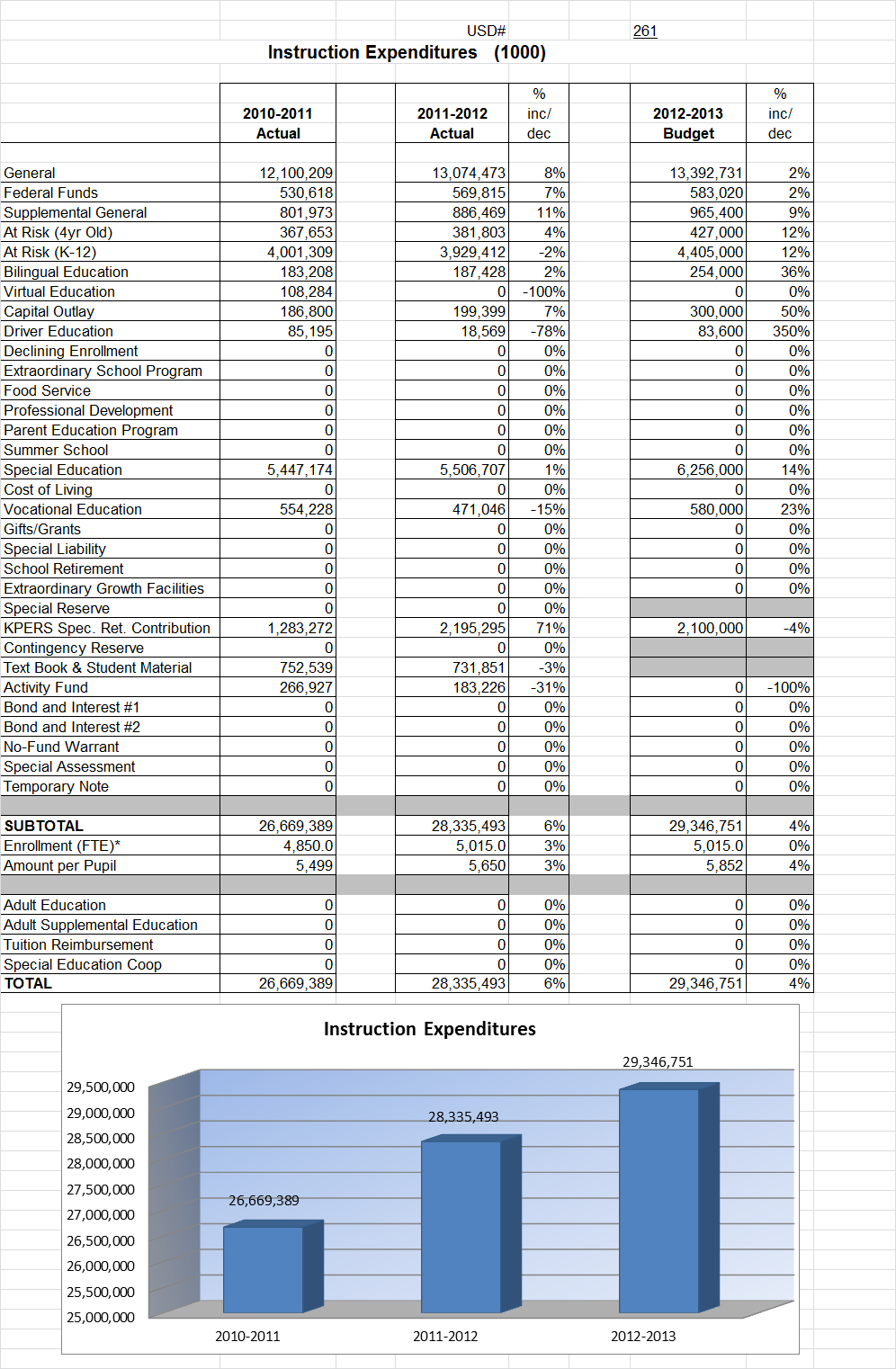

Page 5 ................. Instruction Expenditures

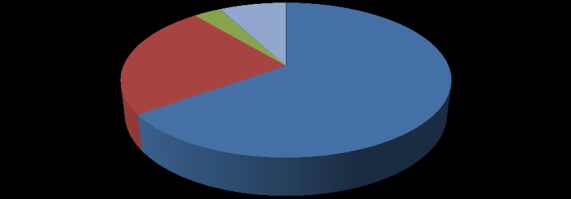

Page 6 ................. Sources of Revenue (state, federal and local) and proposed budget for current year

Page 7 ................. Enrollment and Low Income Students

Page 8 ................. Mill Rates by Fund

Page 9 ................. Assessed Valuation and Bonded Indebtedness

Page 10 ............... Average Salary - This page provides FTE and average salaries for administrators, teachers,

licensed personnel, and substitutes.

Page 11 .............. KSDE website information

•

K-12 statistics (building, district or state totals for attendance, enrollment, staff,

graduates/dropouts, crime/violence)

•

School Finance reports and publications (certified personnel, enrollment, dropouts, graduates,

salary reports)

•

Kansas Building Report Card (rates for attendance, graduation, dropouts, school violence;

reading, math and writing assessments for all districts)

•

Website Information available on the USD 261 website at

www. usd261.com

Coding Expenditures in the Budget Document

(Definitions for Functions, Subfunctions, Objects)

Funds in the USD budget document have a general definition as currently used under Kansas law which

would include such funds ags eneral, vocational education, special education, etc. Within each fund will be a

breakdown by function, subfunction, object and subobject. This document will explain what expenditures

should be charged under which code.

Additional information n cabe found in hte

Kansas Accounting Handbook

which is available on the KSDE

School Finance website (located under

http://www.ksde.org/Default.aspx?tabid=1877

.

This handbook explains in detail how functions, subfunctions and objects are used to breakdown

expenditures in each of the funds, and includes a section with Guidelines for Activity Funds.

USD# 261

STATE OF KANSAS

Budget Form USD-B

CERTIFICATE

2012-2013

TO THE CLERK OF SEDGWICK COUNTY, STATE OF KANSAS

We, the undersigned, duly elected, qualified and acting officers of

UNIFIED SCHOOL DISTRICT 261

certify that: (1) the hearing mentioned in the attached proof of publication was held; (2) after the Budget

Hearing this budget was duly approved and adopted as the maximum expenditure for the various funds for the

year 2012-2013; and (3) the Amount(s) of 2012 Tax to be Levied are within statutory limitations.

TABLE OF CONTENTS:

2012-2013 ADOPTED BUDGET

Amount of

Code

2012 Tax to

County

Clerk's

Adopted Budget

01

Expenditures

be Levied

Use Only

Line

(1)

(2)

(3)

WORKSHEET I

04

STATEMENT OF INDEBTEDNESS

05

FUND

K.S.A.

General

(a)

72-6431

06

30,618,029

2,301,837

20.000(c)

Supplemental General (LOB)

(d)

72-6435

08

10,392,970

3,511,114

Adult Education

72-4523

10

0

0

Adult Supplemental

Education

72-4525

12

0

Bilingual

Education

72-9509

14

254,000

Virtual Education

72-3715

15

0

Capital

Outlay

72-8801

16

3,000,000

670,740

Driver Training

72-6423

18

120,600

Extraordinary

School Program

72-8238

22

0

Food Service

72-5119

24

2,495,000

Professional Development

72-9609

26

163,000

Parent Education Program

72-3607

28

244,256

Summer School

72-8237

29

0

Special

Education

72-6420

30

9,614,000

Vocational Education

72-6421

34

580,000

Special

Liability Expense Fund

72-8248

42

0

0

School Retirement

72-1726

44

0

0

Extraordinary

Growth Facility

72-6441

45

0

0

Special

Reserve Fund

72-8249

47

Federal Funds

12-1663

07

1,000,020

Gifts and Grants

72-8210

35

0

KPERS Special

Retirement Contribution 74-4939a

51

3,260,867

Contingency

Reserve

72-6426

53

Textbook & Student Material Revolving

72-8250

55

At Risk

(4yr Old)

72-6414b

11

465,650

At Risk

(K-12)

72-6414a

13

4,948,800

Cost of Living

72-6449/72-6450

33

0

0

Declining

Enrollment

72-6451

19

0

0

Activity

Funds

72-8208a

56

DEBT SERVICE

Bond and Interest #1

10-113

62

4,448,499

1,532,373

Bond and Interest #2

10-113

63

0

0

No Fund Warrant

(b) 79-2939

66

0

0

Special

Assessment

12-6a10

67

0

Temporary

Note

72-6761

68

0

0

(a) The amount computed on Form 150 is the limit of the 2012-2013 Expenditures.

(b) See K.S.A. 79-2939, order #

dated

//

.

(c) The General Fund levy must be 20 mills. County clerks can't change this levy.

(d) LOB Resolution dated

authorizing

0.00%for 0

yrs.

2nd resolution dated

authorizing

0.00%for 0

yrs.

3rd resolution dated

authorizing

0.00%for 0

yrs.

Date election held to exceed 30%

authorizing

0.00%for 0

yrs.

The resolutions/elections cannot exceed 31%.

8/1/2012 4:28 PM

Code No. 01

Page 1

STATE OF KANSAS

Budget Form USD-B

CERTIFICATE

2012-2013

TABLE OF CONTENTS:

2012-2013 ADOPTED BUDGET

Amount of

Code

2012 Tax to

County Clerk's

Adopted Budget

01

Expenditures

be Levied

Use Only

Line

(1)

(2)

(3)

COOPERATIVES

Special Education

72-968

78

0

Total USD

100

71,605,691

8,016,064

OTHER

Historical Museum

12-1684

80

0

0

Public Library Board

72-1623a

82

0

0

Public Library Board Employees Benefits 12-16,102

83

0

0

Recreation Commission

12-1927

84

0

0

Rec Comm Emp Bnfts & Spec Liab

12-1928/75-6110

86

0

0

Total Other

105

0

0

Publication (Notice of Hearing)

99

Final Assessed Valuation

Municipal Accounting Use Only

Assisted by:

Received _____________________

Reviewed by __________________

Follow-up: Yes ____ No ____

Attest: ________________, 2012

President

County Clerk

Clerk of the Board

FINAL VALUATION

Final Assessed

Final Assessed

County

Valuation

Valuation

Bond and Interest

Home

General Fund*

Other Funds*

#1

#2

$

TOTAL

$0

0

0

0

(General Fund Assessed Valuation excludes $20,000 of appraised value on residential property.)

*Exclude Assessed Valuation due to neighborhood revitalization act (KSA 12-1770, et seg.).

Computation of Delinquency

2010 Delinquent Tax Percentage

3.530

%

Rate Used in this Budget

2.000 %

for 2012-2013

County Clerk's Use Only

8/1/2012 4:28 PM

Code No. 01

Page 2

USD#

261

STATE OF KANSAS

Budget Form USD-B

2012-2013

Resolutions for LEVY LIMITS FOR TAX FUNDS

1. Capital Outlay*:

Resolution dated

12/1/2008

authorizing

8.000

mills for

5 years. Limit

5 years.

2. Increase to Capital Outlay*:

Resolution dated

authorizing

0.000

mills for

0 years. Must expire

same time as original resolution.

3. Adult Education:

Resolution dated

authorizing

0.000

mills for

0 years. Limit

5 years.

4. Historical Museum: Tax Rate authorized by a petition dated

authorizing

mills.

5. Public Library: Resolution dated

authorizing

mills.

6. Recreation Commission: Resolution dated

authorizing

mills.

(Attach a copy of each resolution.)

The USD must have a copy of the separate recreation commission budget before making this levy.

* For any new resolutions 7-1-05 and after, the mill rate may not exceed 8 mills in total.

8/1/2012 4:28 PM

Code No. 02

STATE OF KANSAS

USD# 261

Budget Form USD-C

2012-2013

WORKSHEET I

(Columns (1) through (5) must match Form 110)

Less

Less 2011

Less

FOR FISCAL YEAR 2012-2013

Code

Actual

5.500

Tax

Tax

2011 Tax

Motor Vehicle Recreational

Amount of

Estimate of 2012

04

2011

Allowance

Received

Refunded

In

Tax (includes

Vehicle

2012 Tax to

Taxes 1/1/2013

Line

Tax Levy

for Delinquency in 2011-12

in 2011-12

Process

16/20M Tax)

Tax

be Levied

6/30/2013

Fund

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

General

01

2,295,758

126,267

2,143,805

0

25,686 XXXXXXXXXXX XXXXXXXXXX

2,301,837

2,071,653

Supplemental General

03

3,490,629

191,985

3,240,101

0

58,543

480,787

10,882

3,511,114

3,160,003

Adult Education

05

0

0

0

0

0

0

0

0

0

Capital Outlay

10

534,401

29,392

496,536

0

8,473

81,736

1,850

670,740

603,666

Declining Enrollment

15

0

0

0

0

0

0

0

0

0

School Retirement

20

0

0

0

0

0

0

0

0

0

Special Assessment

25

0

0

0

0

0

0

0

0

0

Spec Liability Expense

30

0

0

0

0

0

0

0

0

0

Bond and Interest #1

40

1,738,655

95,626

1,613,924

0

29,105

304,784

6,898

1,532,373

1,379,136

Bond and Interest #2

45

0

0

0

0

0

0

0

0

0

Temporary Note

50

0

0

0

0

0

0

0

0

0

No-fund Warrant

55

0

0

0

0

0

0

0

0

0

Extraord Gowth Fac

57

0

0

0

0

0

0

0

0

0

Recreation Commission

60

0

0

0

0

0

0

0

0

0

Rec Comm Emp Bnfts & Spec Liab

65

0

0

0

0

0

0

0

0

0

Public Library Board

70

0

0

0

0

0

0

0

0

0

Public Lib Brd Emp Bnfts

71

0

0

0

0

0

0

0

0

0

Historical Museum

75

0

0

0

0

0

0

0

0

0

Cost of Living

78

0

0

0

0

0

0

0

0

0

TOTAL

80

8,059,443

7,494,366

0

867,307

Adult Education Computation – Taxes to be Levied

Assessed Valuation

$134,148,000 x Adult Ed. Mill levy

0.000 =

$0

Taxes to be Levied

Capital Outlay Computation – Taxes to be Levied

Assessed Valuation

$134,148,000 x Capital Outlay Mill levy

5.000 =

$670,740

Taxes to be Levied

Tax Collection Ratio for 2011

92.989 %

8/1/2012

4:29 PM

Code No. 04

Page 1

STATE OF KANSAS

USD#

261

Budget Form USD-D

2012-2013

STATEMENT OF INDEBTEDNESS

Amount Due

Amount Due

Da te

Int.

Amount of

Amount

Date Due

2012-2013

July-Dec. 2013

of

Rate

Bonds

Outstanding

Issue

%

Issued

7/1/2012

Int.

Prin.

Int.

Prin.

Int.

Prin.

Purpose of Debt

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10)

Total

xxxxxxx

xxxxxx

xxxxxxxxxxxxx

0 xxxxxxxx

xxxxxxxx

0

0

0

0

Series 2004 (Refunded)

4/1/2004

3.04

6,880,000

4,655,000

11/1/2012 11/1/2012

79,224

600,000

5/1/2013

70,224

11/1/2013 11/1/2013

70,224

615,000

Series 2005 Refunded

3/1/2005

3.36

8,060,000

6,675,000

11/1/2012 11/1/2012

115,558

730,000

5/1/2013

104,243

11/1/2013 11/1/2013

104,243

760,000

Series 2005

10/15/2005

4.59

20,000,000

18,160,000

11/1/2012

397,250

5/1/2013

397,250

11/1/2013 11/1/2013

397,250

Series 2007

2/1/2007

4.47

29,585,000

28,090,000

11/1/2012 11/1/2012

682,925

505,000

5/1/2013

672,825

11/1/2013 11/1/2013

672,825

520,000

Series 2012

2/1/2012

4.47

2,220,000

2,220,000

11/1/2012 11/1/2012

22,200

50,000

5/1/2013

21,700

11/1/2013 11/1/2013

21,700

50,000

Total

xxxxxxx

xxxxxxx xxxxxxxxxxxxx

59,800,000 xxxxxxxx

xxxxxxxx

2,563,399

1,885,000

1,266,242

1,945,000

If Bond and Interest levies are based on different assessed valuations due to territory changes, show such issues

as a separate group. Use Bond and Interest #2, Code No. 63, for these issues.

Prior to July 1, 1992

After July 1, 1992

8/1/2012 4:29 PM

Code No. 05

STATE OF KANSAS

USD No.

261

Budget Form USD-D1

2012-2013

STATEMENT OF CONDITIONAL LEASE, LEASE–

PURCHASE AND CERTIFICATE OF PARTICIPATION

Term

Total

T otal

Date

of

Int.*

Outright

Other

Amount

Principal

of

Contract

Rate

Purchase

Charges

Financed

Balance Due

Payments Due Payments Due

Contract

(Months)

%

Price

In Contract (Beg Principal)

7/1/2012

2012-2013

July - Dec 2013

Item/Service Purchased

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

(9)

Grandlane Addition

12/1/2003

180

4.50

970,000

970,000

510,000

86,000

86,000

QZAB JC Contract 2011

11/15/2011

204

0.00

1,600,000

1,600,000

1,600,000

0

0

QZAB JC Contract 2012

2/1/2012

120

1.50

1,900,000

1,900,000

1,900,000

205,000

0

TOTAL

$4,470,000

$0

$4,470,000

$4,010,000

$291,000

$86,000

*If you are merely leasing/renting with no intent to purchase, do not list--such transactions are not lease-purchases.

8/1/2012 4:29 PM

Code No. 05a

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

UNENCUMBERED CASH BALANCE JULY 1

01

0

0

0

Cancel of Prior Yr Enc

03

REVENUE:

1000 LOCAL SOURCES

1110 Ad Valorem Tax Levied

2009

$

05

49,531

2010

$

10

2,120,676

28,921

2011

$

15

2,143,805

25,686

2012

$

20

2,071,653

1140 Delinquent

Tax

25

91,027

24,977

63,165

1300 Tuition

1312 Individuals

(Out District)

30

1320 Other School District/Govt Sources In-State

40

1330 Other School District/Govt Sources Out-State

45

1410 Transportation

Fees

47

1700 Student Activities

(Reimbursement)

50

1900 Other Revenue From Local Source

1910 User Charges

55

1980 Reimbursements

60

1985 State Aid Reimbursement****

65

2000 COUNTY SOURCES

2800 In Lieu of Taxes IRBs

85

0

3000 STATE SOURCES

3110 General State Aid

95

22,588,707

22,939,340

23,804,425

3130 Mineral Production Tax

115

314

3205 Special

Education Aid

120

4,185,772

4,571,489

4,653,100

4000 FEDERAL SOURCES

4599 ARRA Stabilization Funds

140

525,430

4604 Ed Jobs Funds

143

920,027

13,694

4820 PL 382

(Exclude Extra Aid

for Children on Indian

Land and Low Rent Housing) (formerly PL 874)*

145

0

5000 OTHER

5208 Transfer From Authorized Funds*****

165

0

29,242

0

RESOURCES AVAILABLE

170

30,481,170

29,751,782

30,618,029

TOTAL EXPENDITURES & TRANSFERS

175

30,481,170

29,751,782

30,618,029

EXCESS REVENUE TO STATE ***

200

0 **

UNENCUMBERED CASH BALANCE JUNE 30

190

0

0 xxxxxxxxxxx

* Only deduct 70% of the estimated 2012-2013 P.L. 382 receipts. The 30% portion not deducted

may be treated as miscellaneous revenue and placed in a fund designated under K.S.A. 72-6427

(categorical aid funds, program weighted funds or capital outlay.)

** Line 170 minus Line 175. (Column 3 only.)

*** Columns 1 & 2 would be amount sent to the State. Do Not Include General State Aid Overpayments.

**** Includes Psychiatric Treatment Centers, Juvenile Detention\Flint Hills Job corporation payments and

State Aid received as a result of adjustments to prior year P.L. 382 deduction (formerly 874),

Teacher Mentoring Program, National Board Certified teacher payments, and Career and

Technical Education state aid for students earning an industry recognized credential in a high

need occupation.

***** 2012 SB11 authorizes transfers from the approved funds to expend unencumbered cash balances

as approved by the local board.

8/1/2012 4:29 PM

Code No. 06

Page 1

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL EXPENDITURES

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

1000 Instruction

100 Salaries

110 Certified

210

9,360,264

9,874,733

10,300,000

120 NonCertified

215

172,779

198,359

250,000

200 Employee Benefits

210 Insurance (Employee)

220

867,183

969,681

1,000,000

220 Social Security

225

859,007

875,856

900,000

290 Other

230

111,654

109,167

125,000

300 Purchased Professional and Technical Services

235

21,746

14,552

25,000

400 Purchased Property Services

237

500 Other Purchased Services

560 Tuition

561 Tuition/other State LEA's

240

562 Tuition/other LEA's outside the State

245

563 Tuition/Priv Sources

250

590 Other

255

375,634

715,313

400,000

600 Supplies

610 General Supplemental (Teaching)

260

244,369

234,273

292,731

644 Textbooks

265

650 Supplies (Technology Related)

267

680 Miscellaneous Supplies

270

53,191

45,623

50,000

700 Property (Equipment & Furnishings)

275

34,382

36,916

50,000

800 Other

280

2000 Support Services

2100 Student Support Services

100 Salaries

110 Certified

285

888,597

884,218

950,000

120 NonCertified

290

211,807

195,765

250,000

200 Employee Benefits

210 Insurance (Employee)

295

88,525

90,314

100,000

220 Social Security

300

81,449

81,329

100,000

290 Other

305

30,844

11,932

30,000

300 Purchased Professional and Technical Services

310

400 Purchased Property Services

313

500 Other Purchased Services

315

591

585

1,000

600 Supplies

320

16,439

16,864

18,000

700 Property (Equipment & Furnishings)

325

800 Other

330

2200 Instr Support Staff

100 Salaries

110 Certified

335

864,597

741,773

800,000

120 NonCertified

340

640,188

662,471

700,000

200 Employee Benefits

210 Insurance (Employee)

345

85,632

98,785

115,000

220 Social Security

350

112,133

102,135

110,000

290 Other

355

13,885

11,951

15,000

300 Purchased Professional

and Technical Services

360

223

534

1,000

400 Purchased Property Services

363

500 Other Purchased Services

365

10,143

10,532

13,000

8/1/2012 4:29 PM

Code No. 06

Page 2

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL EXPENDITURES

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

600 Supplies

640 Books (not textbooks)

and Periodicals

370

45,918

66,864

75,000

650 Technology Supplies

375

24,298

20,059

25,000

680 Miscellaneous Supplies

380

10,257

27,529

20,000

700 Property (Equipment & Furnishings)

385

800 Other

390

17,149

10,054

15,000

2300 General Administration

100 Salaries

110 Certified

395

142,368

145,567

165,000

120 NonCertified

400

76,461

78,820

85,000

200 Employee Benefits

210 Insurance (Employee)

405

19,554

24,410

25,000

220 Social Security

410

14,379

14,323

15,000

290 Other

415

222

331

1,000

300 Purchased Professional

and Technical Services

420

70,376

74,819

75,000

400 Purchased Property Services

425

500 Other Purchased Services

520 Insurance

430

530 Communications

(Telephone, postage, etc.)

435

41,696

58,308

60,000

590 Other

440

9,543

9,601

10,000

600 Supplies

445

13,023

18,080

20,000

700 Property (Equipment & Furnishings)

450

800 Other

455

113,999

31,933

50,000

2400 School Administration

100 Salaries

110 Certified

460

1,257,088

1,240,255

1,300,000

120 NonCertified

465

702,476

710,943

750,000

200 Employee Benefits

210 Insurance (Employee)

470

125,062

144,927

150,000

220 Social Security

475

149,988

148,623

155,000

290 Other

480

19,066

2,992

10,000

300 Purchased Professional

and Technical Services

485

400 Purchased Property Services

490

500 Other Purchased Services

530 Communications

(Telephone, postage, etc.)

495

5,460

5,460

6,000

590 Other

500

17,020

16,151

18,000

600 Supplies

505

35,667

31,439

25,000

700 Property (Equipment & Furnishings)

510

800 Other

515

8/1/2012 4:29 PM

Code No. 06

Page 3

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL EXPENDITURES

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

2600 Operations & Maintenance

100 Salaries

120 NonCertified

520

1,771,971

1,756,841

1,850,000

200 Employee Benefits

210 Insurance (Employee)

525

178,353

190,364

225,000

220 Social Security

530

129,400

128,400

150,000

290 Other

535

8,549

9,781

10,000

300 Purchased Professional

and Technical Services

540

400 Purchased Property Services

411 Water/Sewer

545

65,293

48,670

61,000

420 Cleaning

550

78,091

83,945

85,000

430 Repairs & Maintenance

555

16,358

18,523

18,000

440 Rentals

560

460 Repair of Buildings

565

60,572

81,521

85,000

490 Other

570

3,670

2,343

5,000

500 Other Purchased Services

520 Insurance

575

12,282

14,477

15,000

590 Other

580

30,006

50,891

50,000

600 Supplies

610 General Supplies

585

273,262

325,163

325,000

620 Energy

621 Heating

590

622 Electricity

595

626 Motor Fuel (not schoolbus)

600

22,980

21,616

25,000

629 Other

605

862

780

1,000

680 Miscellaneous Supplies

610

4,972

8,645

10,000

700 Property (Equipment & Furnishings)

615

800 Other

620

2601 Operations & Maintenance (Transportation)

100 Salaries

120 NonCertified

622

200 Employee Benefits

210 Insurance (Employee)

623

220 Social Security

626

290 Other

628

300 Purchased and Professional Technical Services

630

400 Purchased Property Services

632

500 Other Purchased Services

634

600 Supplies

610 General Supplies

636

620 Energy

621 Heating

638

622 Electricity

640

626 Motor Fuel (not schoolbus)

642

629 Other

644

680 Miscellaneous Supplies

646

700 Property (Equipment & Furnishings)

648

800 Other

650

8/1/2012 4:29 PM

Code No. 06

Page 4

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL EXPENDITURES

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

2700 Student Transportation Serv

2720 Supervision

100 Salaries

120 NonCertified

652

159,000

155,475

180,000

200 Employee Benefits

210 Insurance

654

3,391

6,308

8,000

220 Social Security

656

11,971

11,404

15,000

290 Other

658

9,087

10,926

12,000

600 Supplies

660

730 Equipment

662

800 Other

664

2710 Vehicle Operating Services

100 Salaries

120 NonCertified

666

474,302

465,492

500,000

200 Employee Benefits

210 Insurance

668

25,604

27,417

30,000

220 Social Security

670

34,530

34,306

40,000

290 Other

672

457

152

1,000

442 Rent of Vehicles (lease)

674

500 Other Purchased Services

513 Contracting of Bus Services

676

519 Mileage in Lieu of Trans

678

520 Insurance

680

27,029

29,522

30,000

626 Motor Fuel

682

129,700

148,730

150,000

730 Equipment (Including Buses)

684

690

200,330

50,000

800 Other

686

10,569

23,373

25,000

2730 Vehicle Services& Maintenance Services

100 Salaries

120 NonCertified

688

80,327

89,131

120,000

200 Employee Benefits

210 Insurance

690

5,778

6,528

8,000

220 Social Security

692

6,763

6,518

9,000

290 Other

694

90

127

300 Purchased Professional and Tech Services

696

400 Purchased Property Services

698

31,913

49,090

50,000

500 Other Purchased Services

700

600 Supplies

702

56,128

45,174

50,000

730 Equipment

704

800 Other

706

2790 Other Student Transportation Services

100 Salaries

120 NonCertified

708

1,073

887

1,000

200 Employee Benefits

210 Insurance

710

220 Social Security

712

290 Other

714

300 Purchased Professional and Tech Services

716

400 Purchased Property Services

718

500 Other Purchased Services

720

174

112

600 Supplies

722

747

420

730 Equipment

724

800 Other

726

8/1/2012 4:29 PM

Code No. 06

Page 5

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code 2010-2011

2011-2012

2012-2013

GENERAL EXPENDITURES

06

Actual

Actual

Budget

Line

(1)

(2)

(3)

2500, 2900 Other Supplemental Service

100 Salaries

110 Certified

730

120,499

141,290

185,000

120 NonCertified

735

417,026

528,339

560,000

200 Employee Benefits

210 Insurance

740

47,073

50,795

55,000

220 Social Security

745

48,939

49,914

55,000

290 Other

750

647

949

300 Purchased Professional and Technical Services

755

64,635

16,698

35,000

400 Purchased Property Services

760

500 Other Purchased Services

765

11,631

13,349

15,000

600 Supplies

770

80,388

5,280

15,000

700 Property (Equipment & Furnishings)

775

55,148

800 Other

780

3300 Community Services Operations

785

4300 Architectural & Engineering Services

790

5200 TRANSFER TO:

932 Adult Education

795

0

0

0

934 Adult Suppl Education

800

0

0

0

936 Bilingual Education

805

0

0

0

937 Virtual Education

807

68,964

0

0

938 Capital Outlay

810

1,500,000

500,000

0

940 Driver Training

815

0

0

0

943 Extraordinary School Prog

823

0

0

0

944 Food Service

825

0

0

0

946 Professional Development

830

7,305

0

0

948 Parent Education Program

835

15

0

0

949 Summer School

837

0

0

0

950 Special Education

840

4,185,772

4,571,489

4,653,298

954 Vocational Education

850

10,000

0

0

960 Special Reserve Fund

853

0

0

0

963 Special Liability Expense Fund

855

0

0

0

972 Contingency Reserve**

885

11,000

0

0

974 Textbook & Student Materials Revolving Fund

889

100,000

0

0

976 At Risk (4yr Old)

891

225,000

200,000

200,000

978 At Risk (K-12)

893

1,800,000

700,000

1,000,000

TOTAL EXPENDITURES & TRANSFERS*

xxxx

30,481,170

29,751,782

30,618,029

* Enter on Code 06, Line 175.

** The maximum amount of money which can be carried in the Contingency Reserve Fund is

10% of the legal maximum general fund budget.

8/1/2012 4:29 PM

Code No. 06

Page 6

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

Federal Funds

07

Actual

Actual

Budget

(Monies Not Included in Other Funds)

Line

(1)

(2)

(3)

UNENCUMBERED CASH BALANCE JULY 1

01

8

1,957

20

Cancel of Prior Yr Enc

03

REVENUE:

4000 FEDERAL SOURCES-GRANTS

4591 Title I*

010

548,743

641,743

550,000

4593 Title II**

015

147,231

118,343

110,000

4594 Title IV (Drug Free)

020

XXXXXXXXXX

4602 Title IV (21st Century)

022

73,237

215,966

200,000

4597 Reading First

045 XXXXXXXXXX XXXXXXXXXX XXXXXXXXXX

4601 Title III (English Language Acquisition)

060

13,200

16,593

15,000

4603 Charter Schools

062

4599 Other

075

152,995

130,345

125,000

RESOURCES AVAILABLE

170

935,414

1,124,947

1,000,020

TOTAL EXPENDITURES & TRANSFERS

175

933,457

1,124,927

1,000,020

UNENCUMBERED CASH BALANCE JUNE 30

190

1,957

20

0

*This would include programs such as (but not limited to) Migrant; Neglected/Delinquent. This would also

include regular allocations and ARRA recovery funds.

**This would include programs such as (but not limited to) Title II-A Teacher Quality; Title II-D Education

Technology. This would also include regular allocations and ARRA recovery funds.

8/1/2012 4:29 PM

Code No. 07

Page 1

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

Federal Funds Expenditures

07

Actual

Actual

Budget

(Monies Not Included in Other Funds)

Line

(1)

(2)

(3)

1000 Instruction

100 Salaries

110 Certified

210

402,472

389,482

410,000

120 NonCertified

215

66,277

71,171

90,000

200 Employee Benefits

210 Insurance (Employee)

220

24,062

28,473

28,000

220 Social Security

225

26,964

25,415

25,000

290 Other

230

420

539

300 Purchased Professional and Technical Services

235

737

29,939

4,000

400 Purchased Property Services

237

500 Other Purchased Services

560 Tuition

561 Tuition/other State LEA's

240

562 Tuition/other LEA's outside the State

245

563 Tuition/Priv Sources

250

590 Other

255

1,322

1,719

1,020

600 Supplies

610 General Supplemental (Teaching)

260

1,396

19,591

5,000

644 Textbooks

265

650 Supplies (Technology Related)

267

680 Miscellaneous Supplies

270

4,713

423

5,000

700 Property (Equipment & Furnishings)

275

2,600

800 Other

280

2,255

463

15,000

2000 Support Services

2100 Student Support Services

100 Salaries

110 Certified

285

22,982

33,754

40,000

120 NonCertified

290

31,116

50,852

60,000

200 Employee Benefits

210 Insurance (Employee)

295

3,715

3,168

4,000

220 Social Security

300

3,870

5,206

6,000

290 Other

305

51

200

300 Purchased Professional and Technical Services

310

51,293

102,979

50,000

400 Purchased Property Services

313

500 Other Purchased Services

315

5,856

18,658

20,000

600 Supplies

320

56,832

102,641

55,000

700 Property (Equipment & Furnishings)

325

23

800 Other

330

1,665

3,000

2200 Instr Support Staff

100 Salaries

110 Certified

335

43,422

30,350

40,000

120 NonCertified

340

200 Employee Benefits

210 Insurance (Employee)

345

220 Social Security

350

3,160

1,533

2,000

290 Other

355

43

310

300 Purchased Professional

and Technical Services

360

10,210

10,000

400 Purchased Property Services

363

500 Other Purchased Services

365

97,252

159,212

100,000

8/1/2012 4:29 PM

Code No. 07

Page 2

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

Federal Funds Expenditures

07

Actual

Actual

Budget

(Monies Not Included in Other Funds)

Line

(1)

(2)

(3)

600 Supplies

640 Books (not textbooks)

and Periodicals

370

650 Technology Supplies

375

680 Miscellaneous Supplies

380

32,110

9,639

25,000

700 Property (Equipment & Furnishings)

385

800 Other

390

2300 General Administration

100 Salaries

110 Certified

395

2,271

552

2,000

120 NonCertified

400

200 Employee Benefits

210 Insurance (Employee)

405

220 Social Security

410

290 Other

415

300 Purchased Professional

and Technical Services

420

400 Purchased Property Services

425

500 Other Purchased Services

520 Insurance

430

530 Communications

(Telephone, postage, etc.)

435

590 Other

440

600 Supplies

445

700 Property (Equipment & Furnishings)

450

800 Other

455

2400 School Administration

100 Salaries

110 Certified

460

120 NonCertified

465

200 Employee Benefits

210 Insurance (Employee)

470

220 Social Security

475

290 Other

480

300 Purchased Professional

and Technical Services

485

400 Purchased Property Services

490

500 Other Purchased Services

530 Communications

(Telephone, postage, etc.)

495

590 Other

500

600 Supplies

505

700 Property (Equipment & Furnishings)

510

800 Other

515

8/1/2012 4:29 PM

Code No. 07

Page 3

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

Federal Funds Expenditures

07

Actual

Actual

Budget

(Monies Not Included in Other Funds)

Line

(1)

(2)

(3)

2600 Operations & Maintenance

100 Salaries

120 NonCertified

520

200 Employee Benefits

210 Insurance (Employee)

525

220 Social Security

530

290 Other

535

300 Purchased Professional

and Technical Services

540

400 Purchased Property Services

411 Water/Sewer

545

420 Cleaning

550

430 Repairs & Maintenance

555

440 Rentals

560

460 Repair of Buildings

565

490 Other

570

500 Other Purchased Services

520 Insurance

575

590 Other

580

600 Supplies

610 General Supplies

585

620 Energy

621 Heating

590

622 Electricity

595

626 Motor Fuel (not schoolbus)

600

629 Other

605

680 Miscellaneous Supplies

610

700 Property (Equipment & Furnishings)

615

800 Other

620

2,056

2700 Student Transportation Services

2710 Vehicle Operating Services

100 Salaries

120 NonCertified

625

11,627

12,565

200 Employee Benefits

210 Insurance

630

220 Social Security

635

889

958

290 Other

640

12

19

442 Rent of Vehicles (lease)

645

500 Other Purchased Services

513 Contracting of Bus Services

650

5,012

5,300

519 Mileage in Lieu of Trans

655

520 Insurance

660

626 Motor Fuel

665

744

1,999

730 Equipment (including buses)

670

800 Other

675

8/1/2012 4:29 PM

Code No. 07

Page 4

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

Federal Funds Expenditures

07

Actual

Actual

Budget

(Monies Not Included in Other Funds)

Line

(1)

(2)

(3)

2500, 2900 Other Supplemental Service

100 Salaries

110 Certified

680

120 NonCertified

685

200 Employee Benefits

210 Insurance

690

220 Social Security

695

290 Other

700

300 Purchased Professional and Technical Services

705

400 Purchased Property Services

710

500 Other Purchased Services

715

2,056

600 Supplies

720

700 Property (Equipment & Furnishings)

725

1,800

800 Other

730

16,493

11,496

3000 Operation of Noninstructional Services

3100 Food Service Operation

100 Salaries

110 Certified

735

120 NonCertified

740

200 Employee Benefits

210 Insurance

745

220 Social Security

750

290 Other

755

500 Other Purchased Services

520 Insurance

760

570 Food Service Management

765

590 Other Purchased Services

770

600 Supplies

630 Food & Milk

775

680 Miscellaneous Supplies

780

700 Property (Equipment & Furnishings)

785

800 Other

790

3300 Community Services Operations

795

4300 Architectural & Engineering Services

800

TOTAL EXPENDITURES & TRANSFERS

xxxx

933,457

1,124,927

1,000,020

8/1/2012 4:29 PM

Code No. 07

Page 5

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

SUPPLEMENTAL GENERAL

Code

2010-2011

2011-2012

2012-2013

(LOCAL OPTION)

08

Actual

Actual

Budget

Line

(1)

(2)

(3)

UNENCUMBERED CASH BALANCE JULY 1

01

144,306

150,377

351,367

Cancel of Prior Year Encumbrances

03

REVENUE:

1000 LOCAL SOURCES

1110 Ad Valorem Tax Levied

2009 $

10

66,154

2010 $

15

2,749,454

54,975

2011 $

20

3,240,101

58,543

1140 Delinquent Tax

25

109,275

47,902

96,041

1410 Transportation Fees

47

1980 Reimbursements

60

28,056

24,430

2000 COUNTY SOURCES

2400 Motor Vehicle Tax (Includes 16/20M Tax)

70

380,709

461,479

480,787

2450 Recreational Vehicle Tax

75

10,882

2800 In Lieu of Taxes IRBs

85

0

3000 STATE SOURCES

3140 Supplemental State Aid

95

6,512,440

6,553,776

6,297,308

4000 FEDERAL SOURCES

4599 ARRA Stabilization Funds

140

XXXXXXXXX

XXXXXXXX

XXXXXXXX

RESOURCES AVAILABLE

170

9,990,394

10,533,040

7,294,928

TOTAL EXPENDITURES & TRANSFERS

175

9,840,017

10,181,673

10,392,970

TAX REQUIRED (175 minus 170)

195

3,098,042

PERCENT OF COLLECTION*

196

90.000 %

TOTAL 2012 TAX REQUIRED (195÷196)

197

3,442,269

Delinquent Tax

200

68,845

AMOUNT OF 2012 TAX TO BE LEVIED

Line 197 + Line 200

205

3,511,114

UNENCUMBERED CASH BALANCE JUNE 30

207

150,377

351,367 xxxxxxxxxxx

*From Form 110, Table I, Line 2.

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

SUPPLEMENTAL GENERAL EXPENDITURES

08

Actual

Actual

Budget

(LOCAL OPTION)

Line

(1)

(2)

(3)

1000 Instruction

.

100 Salaries

110 Certified

210

126,175

142,646

165,000

120 NonCertified

215

200 Employee Benefits

210 Insurance (Employee)

220

220 Social Security

225

290 Other

230

300 Purchased Professional and Technical Services 235

400 Purchased Property Services

237

500 Other Purchased Services

560 Tuition

561 Tuition/other State LEA's

240

562 Tuition/other LEA's outside the State

245

563 Tuition/Priv Sources

250

590 Other

255

600 Supplies

610 General Supplemental(Teaching)

260

324

215

400

644 Textbooks

265

650 Supplies (Technology Related)

267

680 Miscellaneous Supplies

270

700 Property (Equipment & Furnishings)

275

675,474

743,608

800,000

800 Other

280

8/1/2012 4:29 PM

Code No. 08

Page 1

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

SUPPLEMENTAL GENERAL

08

Actual

Actual

Budget

(LOCAL OPTION)

Line

(1)

(2)

(3)

2000 Support Services

2100 Student Support Services

100 Salaries

110 Certified

285

77,340

88,885

120,000

120 Non-Certified

290

200 Employee Benefits

210 Insurance (Employee)

295

3,715

4,224

5,000

220 Social Security

300

6,218

7,249

9,000

290 Other

305

83

154

300 Purchased Professional and Technical Serv

310

400 Purchased Property Services

313

500 Other Purchased Services

315

600 Supplies

320

700 Property (Equipment & Furnishings)

325

53,044

68,814

75,000

800 Other

330

2200 Instr Support Staff

100 Salaries

110 Certified

335

132,740

138,659

168,000

120 NonCertified

340

200 Employee Benefits

210 Insurance (Employee)

345

3,655

4,139

5,000

220 Social Security

350

10,111

10,484

12,000

290 Other

355

133

205

300 Purchased Professional and Technical Serv

360

6,836

6,960

8,000

400 Purchased Property Services

363

500 Other Purchased Services

365

1,336

1,193

2,000

600 Supplies

640 Books (not textbooks) and Periodicals

370

89

650 Technology Supplies

375

4,418

3,014

5,000

680 Miscellaneous Supplies

380

19,512

20,208

25,000

700 Property (Equipment & Furnishings)

385

5,844

5,000

800 Other

390

2300 General Administration

100 Salaries

110 Certified

395

120 NonCertified

400

200 Employee Benefits

210 Insurance (Employee)

405

220 Social Security

410

290 Other

415

300 Purchased Professional and Technical Services 420

400 Purchased Property Services

425

500 Other Purchased Services

520 Insurance

430

421,190

93,483

400,000

530 Communications (Telephone, postage, etc.)

435

590 Other

440

600 Supplies

445

700 Property (Equipment & Furnishings)

450

3,849

179

5,000

800 Other

455

15,063

52,295

35,000

8/1/2012 4:29 PM

Code No. 08

Page 2

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

SUPPLEMENTAL GENERAL

08

Actual

Actual

Budget

(LOCAL OPTION)

Line

(1)

(2)

(3)

2400 School Administration

100 Salaries

110 Certified

460

120 Non-Certified

465

200 Employee Benefits

210 Insurance (Employee)

470

220 Social Security

475

290 Other

480

300 Purchased Professional and Technical Services 485

400 Purchased Property Services

490

500 Other Purchased Services

530 Communications (Telephone, postage, etc.)

495

590 Other

500

600 Supplies

505

700 Property (Equipment & Furnishings)

510

800 Other

515

2600 Operations & Maintenance

100 Salaries

120 Non-Certified

520

41,518

50,105

80,000

200 Employee Benefits

210 Insurance (Employee)

525

2,526

4,139

5,000

220 Social Security

530

3,096

3,718

5,000

290 Other

535

41

72

300 Purchased Professional and Technical Services 540

400 Purchased Property Services

411 Water/Sewer

545

5,769

4,450

7,500

420 Cleaning

550

821

872

1,000

430 Repairs & Maintenance

555

358

74

1,000

440 Rentals

560

460 Repair of Buildings

565

1,114

490 Other

570

2,019

2,335

2,000

500 Other Purchased Services

520 Insurance

575

590 Other

580

3,360

2,951

5,000

600 Supplies

610 General Supplies

585

9,827

15,440

15,000

620 Energy

621 Heating

590

154,195

94,761

300,000

622 Electricity

595

515,816

503,363

750,000

626 Motor Fuel

(not schoolbus)

600

629 Other

605

680 Miscellaneous Supplies

610

700 Property

(Equipment & Furnishings)

615

800 Other

620

8/1/2012 4:29 PM

Code No. 08

Page 3

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

SUPPLEMENTAL GENERAL

08

Actual

Actual

Budget

(LOCAL OPTION)

Line

(1)

(2)

(3)

2601 Operations & Maintenance (Transportation)

100 Salaries

120 NonCertified

622

200 Employee Benefits

210 Insurance (Employee)

623

220 Social Security

626

290 Other

628

300 Purchased and Professional Technical Services

630

400 Purchased Property Services

632

500 Other Purchased Services

634

600 Supplies

610 General Supplies

636

620 Energy

621 Heating

638

622 Electricity

640

626 Motor Fuel (not schoolbus)

642

629 Other

644

680 Miscellaneous Supplies

646

700 Property (Equipment & Furnishings)

648

800 Other

650

2700 Student Transportation

Serv

2720 Supervision

100 Salaries

120 NonCertified

652

200 Employee

Benefits

210 Insurance

654

220 Social Security

656

290 Other

658

600 Supplies

660

730 Equipment

662

800 Other

664

2710 Vehicle Operating

Services

100 Salaries

120 NonCertified

666

200 Employee

Benefits

210 Insurance

668

220 Social Security

670

290 Other

672

442 Rent of Vehicles

(lease)

674

500 Other Purchased Services

513 Contracting

of Bus Services

676

519 Mileage

in Lieu of Trans

678

520 Insurance

680

626 Motor Fuel

682

730 Equipment

(Including Buses)

684

800 Other

686

2730 Vehicle Services& Maintenance Services

100 Salaries

120 NonCertified

688

200 Employee

Benefits

210 Insurance

690

220 Social Security

692

290 Other

694

300 Purchased Professional and Tech Services

696

400 Purchased Property

Services

698

500 Other Purchased Services

700

600 Supplies

702

730 Equipment

704

800 Other

706

8/1/2012 4:29 PM

Code No. 08

Page 4

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

SUPPLEMENTAL GENERAL

08

Actual

Actual

Budget

(LOCAL OPTION)

Line

(1)

(2)

(3)

2790 Other Student Transportation

Services

100 Salaries

120 NonCertified

708

200 Employee

Benefits

210 Insurance

710

220 Social Security

712

290 Other

714

300 Purchased Professional and Tech Services

716

400 Purchased Property

Services

718

500 Other Purchased Services

720

600 Supplies

722

730 Equipment

724

800 Other

726

2500,

2900 Other Supplemental Services

100 Salaries

110 Certified

730

62,077

69,198

80,000

120 NonCertified

735

200 Employee

Benefits

210 Insurance

740

31,711

8,744

10,000

220 Social Security

745

4,707

5,240

6,000

290 Other

750

230,607

154,427

250,000

300 Purchased Professional and Technical Services 755

15,803

17,944

20,000

400 Purchased Property

Services

760

3,191

4,000

5,000

500 Other Purchased Services

765

7,001

96,196

100,000

600 Supplies

770

2,261

1,437

3,000

700 Property

(Equipment & Furnishings)

775

1,588

1,663

3,000

800 Other

780

49,706

50,824

200,000

3300 Community

Services Operations 785

4300 Architectural & Engineering

Services

790

1,738

5200 TRANSFER TO:

930 General

(Not Ending Balance)

792

0

0

0

932 Adult Education

795

0

0

0

934 Adult Suppl

Education

800

0

0

0

936 Bilingual

Education

805

185,000

200,000

200,000

937 Virtual Education

810

0

0

0

940 Driver Training

815

50,000

0

0

943 Extraordinary

School Prog

823

0

0

0

944 Food Service

825

0

0

0

946 Professional Development

830

0

50,000

50,000

948 Parent Education Program

835

130,000

120,000

85,000

949 Summer School

837

0

0

0

950 Special

Education

840

2,865,803

2,724,321

2,565,070

954 Vocational Education

850

650,000

500,000

500,000

963 Special

Liability Expense Fund

855

0

0

0

974 Textbook & Student Materials Revolving

880

300,000

100,000

100,000

976 At Risk

(4yr Old)

885

200,000

200,000

200,000

978 At Risk

(K-12)

890

2,750,000

3,800,000

3,000,000

TOTAL EXPENDITURES & TRANSFERS*

xxxx

9,840,017

10,181,673

10,392,970

* Enter on Code 08, Line 175.

8/1/2012 4:29 PM

Code No. 08

Page 5

STATE OF KANSAS

USD#

261

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

AT RISK FUND (4 Year Old)

11

Actual

Actual

Budget

Line

(1)

(2)

(3)

UNENCUMBERED CASH BALANCE JULY 1

01

397,596

412,168

396,632

Cancel of Prior Year Encumbrance

03

REVENUE:

1000 LOCAL SOURCES

1300 Tuition

1312 Individuals

05

1315 Individual

(Summer School)

15

1320 Other School District/Govt Sources In-State

25

1510 Interest on Idle Funds

35

1700 Student Activities(Reimbursement)

45

1900 Other Revenue From Local Source

1990 Miscellaneous

75

4000 FEDERAL SOURCES

4590 Other Federal Aid

115

5000 OTHER

5206 Transfer From General

135

225,000

200,000

200,000

5208 Transfer From Supplemental

General

140

200,000

200,000

200,000

5253 Transfer From Contingency

Reserve

145

0

0 xxxxxxxxxxxxx

RESOURCES

AVAILABLE

170

822,596

812,168

796,632

TOTAL EXPENDITURES & TRANSFERS

175

410,428

415,536

465,650

UNENCUMBERED CASH BALANCE JUNE 30

190

412,168

396,632

330,982

12 mo.

12 mo.

12 mo.

AT RISK

FUND (4 Year Old)

Code

2010-2011

2011-2012

2012-2013

EXPENDITURES

11

Actual

Actual

Budget

Line

(1)

(2)

(3)

1000 Instruction

100 Salaries

110 Certified

210

228,996

240,160

260,000

120 NonCertified

215

70,078

73,198

90,000

200 Employee

Benefits

210 Insurance

(Employee)

220

38,897

37,202

40,000

220 Social Security

225

21,984

23,377

25,000

290 Other

230

292

489

300 Purchased Professional and Technical Services

235

400 Purchased Property

Services

237

500 Other Purchased Services

560 Tuition

561 Tuition/other State LEA's

240

563 Tuition/Priv Sources

245

590 Other

250

5,421

6,819

10,000

600 Supplies

610 General Supplemental

(Teaching)

255

1,985

558

2,000

644 Textbooks

260

650 Supplies

(Technology Related)

263

680 Miscellaneous Supplies

265

700 Property

(Equipment & Furnishings)

270

800 Other

275

2000 Support

Services

2100 Student Support

Services

100 Salaries

110 Certified

280

120 NonCertified

285

215

347

500

8/15/2012 10:31 AM

Code No. 11

Page 1

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

AT RISK FUND (4 Year Old)

Code

2010-2011

2011-2012

2012-2013

EXPENDITURES

11

Actual

Actual

Budget

Line

(1)

(2)

(3)

200 Employee Benefits

210 Insurance (Employee)

290

220 Social Security

295

16

27

290 Other

300

1

300 Purchased Professional and Technical Services

305

400 Purchased Property Services

307

500 Other Purchased Services

310

600 Supplies

315

76

99

700 Property (Equipment & Furnishings)

320

800 Other

325

2200 Instr Support Staff

100 Salaries

110 Certified

330

120 NonCertified

335

200 Employee Benefits

210 Insurance (Employee)

340

220 Social Security

345

290 Other

350

300 Purchased Professional and Technical Services

355

400 Purchased Property Services

357

500 Other Purchased Services

360

600 Supplies

640 Books(not textbooks)and Periodicals

365

650 Technology Supplies

370

680 Miscellaneous Supplies

375

700 Property (Equipment & Furnishings)

380

800 Other

385

2400 School Administration

100 Salaries

110 Certified

390

27,099

16,279

20,000

120 NonCertified

395

10,213

10,410

11,000

200 Employee

Benefits

210 Insurance

(Employee)

400

1,224

324

3,000

220 Social Security

405

2,862

1,910

3,000

290 Other

410

37

3,873

300 Purchased Professional and Technical Services

415

500 Other Purchased Services

420

140

420

150

600 Supplies

425

700 Property

(Equipment & Furnishings)

430

800 Other

435

2600 Operations

& Maintenance

100 Salaries

120 NonCertified

440

200 Employee

Benefits

210 Insurance

(Employee)

445

220 Social Security

450

290 Other

455

300 Purchased Professional and Technical Services

460

8/15/2012 10:31 AM

Code No. 11

Page 2

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

AT RISK FUND (4 Year Old)

Code

2010-2011

2011-2012

2012-2013

EXPENDITURES

11

Actual

Actual

Budget

Line

(1)

(2)

(3)

400 Purchased Property

Services

411 Water/Sewer

465

420 Cleaning

470

430 Repairs

& Maintenance

475

440 Rentals

480

490 Other

485

500 Other Purchased Services

490

600 Supplies

610 General Supplies

495

893

1,000

620 Energy

621 Heating

500

622 Electricity

505

626 Motor Fuel

(not schoolbus)

510

629 Other

515

680 Miscellaneous Supplies

520

700 Property

(Equipment & Furnishings)

525

800 Other

530

2700 Student Transportation

Services

120 NonCertified Salaries

531

200 Employee

Benefits

532

800 Other

533

43

2500,

2900 Other Supplemental Services

100 Salaries

110 Certified

535

120 NonCertified

540

200 Employee

Benefits

210 Insurance

545

220 Social Security

550

290 Other

555

300 Purchased Professional and Technical Services

560

400 Purchased Property

Services

565

500 Other Purchased Services

570

600 Supplies

575

700 Property

(Equipment & Furnishings)

580

800 Other

585

5200 TRANSFER TO:

930 General Fund

595

TOTAL EXPENDITURES & TRANSFERS

xxxx

410,428

415,536

465,650

8/15/2012 10:31 AM

Code No. 11

Page 3

STATE OF KANSAS

USD# 261

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

Code

2010-2011

2011-2012

2012-2013

AT RISK FUND (K-12)

13

Actual

Actual

Budget

Line

(1)

(2)

(3)

UNENCUMBERED CASH BALANCE JULY 1

01

1,051,609

1,200,061

1,370,646

Cancel of Prior Year Encumbrance

03

REVENUE:

1000 LOCAL SOURCES

1300 Tuition

1312 Individuals

05

1315 Individual

(Summer School)

15

34,502

28,491

30,000

1320 Other School District/Govt Sources In-State

25

1510 Interest on Idle Funds

35

1700 Student Activities(Reimbursement)

45

1900 Other Revenue From Local Source

1990 Miscellaneous

75

4000 FEDERAL SOURCES

4590 Other Federal Aid

115

5000 OTHER

5206 Transfer From General

135

1,800,000

700,000

1,000,000

5208 Transfer From Supplemental General

140

2,750,000

3,800,000

3,000,000

5253 Transfer From Contingency

Reserve

145

0

65,000 xxxxxxxxxxxxx

RESOURCES AVAILABLE

170

5,636,111

5,793,552

5,400,646

TOTAL EXPENDITURES & TRANSFERS

175

4,436,050

4,422,906

4,948,800

UNENCUMBERED CASH BALANCE JUNE 30

190

1,200,061

1,370,646

451,846

12 mo.

12 mo.

12 mo.

AT RISK FUND

(K-12)

Code

2010-2011

2011-2012

2012-2013

EXPENDITURES

13

Actual

Actual

Budget

Line

(1)

(2)

(3)

1000 Instruction

100 Salaries

110 Certified

210

3,575,541

3,517,392

3,900,000

120 NonCertified

215

51,791

64,225

80,000

200 Employee

Benefits

210 Insurance

(Employee)

220

24,015

25,098

30,000

220 Social Security

225

103,940

128,559

130,000

290 Other

230

29,962

40,102

50,000

300 Purchased Professional and Technical Services

235

400 Purchased Property

Services

237

500 Other Purchased Services

560 Tuition

561 Tuition/other State LEA's

240

563 Tuition/Priv Sources

245

590 Other

250

7,167

10,842

15,000

600 Supplies

610 General Supplemental

(Teaching)

255

17,226

11,796

15,000

644 Textbooks

260

123,951

125,881

125,000

650 Supplies

(Technology Related)

263

63,349

50,000

680 Miscellaneous Supplies

265

700 Property

(Equipment & Furnishings)

270

4,367

5,517

10,000

800 Other

275

2000 Support

Services

2100 Student Support

Services

100 Salaries

110 Certified

280

120 NonCertified

285

8/1/2012 4:29 PM

Code No. 13

Page 1

USD# 261

STATE OF KANSAS

Budget Form USD-E

2012-2013

12 mo.

12 mo.

12 mo.

AT RISK FUND (K-12)

Code

2010-2011

2011-2012

2012-2013

EXPENDITURES

13

Actual

Actual

Budget

Line

(1)

(2)

(3)

200 Employee Benefits

210 Insurance (Employee)

290

220 Social Security

295

290 Other

300

300 Purchased Professional and Technical Services

305

5,000

10,000

10,000

400 Purchased Property Services

307

500 Other Purchased Services

310

600 Supplies

315

149

79

700 Property (Equipment & Furnishings)

320

800 Other

325

2200 Instr Support Staff

100 Salaries

110 Certified

330

181,972

192,547

225,000

120 NonCertified

335

200 Employee Benefits

210 Insurance (Employee)

340

11,146

12,671

15,000

220 Social Security

345

13,931

14,762

15,000

290 Other

350

186

314

300 Purchased Professional and Technical Services

355

400 Purchased Property Services

357

500 Other Purchased Services

360

551

422

500

600 Supplies