Flexible Benefits Guide

2009-10

Welcome to MGM Benefits Group, Section 125 Plans!

With over 30 years experience in the employee benefits administration, MGM Benefits Group

has partnered with your employer to bring you a state of the arts flexible benefits plan.

We’e enhanc

eb

ed

site

o

to

u

b

r

ring you the best advancements in flex administration. Now

you can go to your own participant website to:

?

Create your own account password. You can also re-set your own password in case

you forget!

?

File claims online

?

Create your direct deposit accounts

?

Receive emails regarding information required to process your claims

?

Download our Heath FSA, Dependent Care FSA claim forms, status change and deposit

forms.

We encourage you to review the information in this guide so you can make informed

decisions about using the funds in your account for you and your family.

Contact Us:

Benefit counselors are available to assist you from 8 a.m. to 5:30 p.m. Central Standard Time,

Monday through Thursday and 8 a.m. to 2:00 p.m. on Fridays.

Mail Claims:

MGM Benefits Group

2121 N. Glenville Drive

Richardson, TX 75082

Contact Phone: (800) 833-4028

Fax Claims:

(800) 973-3702

Website:

www.mgmflex.com

Questions:

flexSupport@mgmbenefits.com

Flexible Benefits Guide

A Section 125 Plan is a part of the Internal Revenue Code that

allows employees to convert a taxable cash benefit (salary)

into non-taxable benefits. You may choose to pay for benefit

premiums and other qualified expenses before any taxes are

deducted from your paycheck.

How the Plan Works

Under Section 125, your employers Plan may offer the option

to include the premium cost for your employee benefit plans.

You may pay the premiums pre-tax for your medical, dental,

cancer and vision insurances. Your plan may also offer flexible

spending accounts for your health care and dependent care

needs.

Back to top

Flexible Spending Accounts

A Flexible Spending Account (FSA) is a special account for

healthcare and dependent care expenses. When you enroll in

an FSA, you decide how much to contribute to each account

for the entire Plan Year. This annual contribution is then

deducted in equal amounts from your paycheck, before

Federal & State income taxes and FICA taxes are deducted.

These

-

tax“preed” fuds ar

atical

e

ly d

au

epos

to

ited in your

account through payroll deduction. Unless you have a

qualifying event under Section 125 regulations, your election

amount will not change during the Plan year.

Flexible Benefits Guide

MGM Benefits Group

Back to top

Section 125 Plan

Using Your Flexible Spending Account

Your employer may offer one or both Flexible Spending

Accounts: Health FSA and/or Dependent Care FSA. Although you

can choose to participate in both accounts, funds may not be

co-mingled. Expenses for these accounts must be incurred

durig our eploer’s pla ear.

Expenses for the funds in your flex account must be

incurred

by

the end of the plan year or they will be subject to the

“use it or

lose

rul

i

es

t

reg

”

ulated by the Internal Revenue Service. Based

o our Eloer’s fleile eefits pla, ou have a spefied

date following the end of the plan year to submit your receipts

for reimbursement. All funds still remaining in your account will

be forfeited after this claim period ends.

Please check with the Plan Administrator at your employment

to verify the last date that you may file claims for your

reimbursement expenses.

F

S A’s

MGM Benefits Group

Section 125 Plan

Eligible Health Expenses

The Health Care FSA is a tax-free account that allows you to pay for essential health care expenses that are

not covered, or are partially covered, by your medical, dental and vision insurance plans.

These expenses may be incurred by you or your eligible dependents. Expenses include deductibles, co-

insurance payments, office co-pays, orthodontics, glasses and contacts. The item must not be used for

general health or cosmetic purposes.

OceerollediFS’sth

i

e

lab

ey

le to

i

yo

s

u

a

on

v

th

a

e first day of

the plan. You must spend the funds by the end of the plan year or they will be forfeited from your account.

Orthodontic Expenses

IRS stipulates how orthodontic expenses can be

reimbursed in a health care FSA. You should carefully

plan when deciding on your annual election if it

includes orthodontic expenses.

Special planning should be considered if you are

planning to take advantage of an up-front discount

payment. Please remember, services must be

performed and incurred within the current plan year.

Reimbursement of a lump sum payment to a dentist

may not be eligible if any of the services will be

performed in a subsequent plan year.

Health Care

flexible spending account

Eligible Health Care Expenses

Dental Services

Oxygen equipment

Crowns & Bridges

Prosthesis

Dentures

Wheelchair

Exams/Teeth cleaning

Medical Services & Providers

Extractions

Acupuncture

Fillings

Anesthetist

Implants

Chiropractic care

Oral surgery

Hospital services

Orthodontia/Braces

Immunizations & Vaccinations

Insurance

Injections and vaccinations

Co-pays

Nursing Services

Deductibles

Physical therapy

Medications

Operating room fees

Contraceptives

Optometrist/Ophthalmologist fees

Drugs

(prescriptions)

Organ transplant

Insulin treatment

Specialty physicians & surgeons

Over-the-Counter items

Sterilization

Smoking cessation products

Surgery

Laboratory Fees & Tests

Transportation to medical care

Blood tests & transfusions

Transplants

Diagnostic tests/health screenings

Obstetric Services

Lab fees

OB/GYN Exams & treatment

X-rays

OB/GYN Prepaid Maternity fees

Medical Equipment & Supplies

Vision Services

Ambulance service

Contact lenses

(corrective)

& supplies

Crutches

Eye exams

Guide dog

Eyeglasses & Sunglasses

(corrective)

Hearing aids and batteries

Laser eye surgery

Health Care

flexible spending account

Non-eligible items

Cosmetic surgery/Procedures

Dietary supplements

(vitamins)

Electrolysis

Exercise or health club memberships

Insurance premiums

Personal care items

Physical therapy for general well being

Smoking cessation programs

Teeth whitening/Bleaching

Weight reduction

(fees, programs & food)

So ite y euie the sussio of

ce

a

rti

Do

ficati

’s

on

stating the nature of medical condition and required treatment

Partial List of Medically Necessary Items

Over-the-Counter Items

The IRS allows that some over the counter (OTC) drugs and medications which are used to treat sickness

may be reimbursed by Health Care Flexible Spending Accounts.

Eligible expenses include medicines or products that alleviate or treat personal injuries or illness for you

and your dependents.

Fo st OTC’s, you ae ot euied

at

t

em

o

en

p

t f

o

rom

vi

a

d

me

e

dic

a

al

st

provider or indicate a diagnosis in order to receive reimbursement.

Receipts for reimbursement must state the place of purchase, date, amount, item name, and can be

claimed within reasonable quantities. We recommend that you retain copies of all OTC receipts for your

records.

There are some medical items that may not be allowed unless you are diagnosed by a medical

professional for a specific medical condition. Treatment for eligible expenses cannot be for preventative

purposes.

Items purchased for personal care are not eligible for reimbursement. For example, toothpaste,

vitamins, supplements and herbal remedies, and other items used for personal hygiene cannot be

claimed for reimbursement.

Health

flexible spending account

Over The Counter Items

Partial List of

OTC’s

Allergy

Other Items for Medical Care

Antihistamines

Anti-diarrheas

Nasal sprays

Anti-fungals

Antacids

Antibiotics

Heartburn medicines

Asthma medications

Cold Remedies

Bandages, gauze, rubbing alcohol

Cough drops

Carpal tunnel wrist

Decongestants

sCuppold/ohorts

t packs for

Nasal strips

iCnjuontaries

ct lens drops & cleaning

Nasal sprays

sEoye

lutiproons

ducts (reading

Sinus Medications

gFilrasst sesaid )

kits

Throat lozenges

Hemorrhoid treatments

Pain Relief

Laxatives

Bug bite medication

Motion sickness treatments

Fever reducers

Smoking cessation products

First aid creams

(diaper, fever

blister, etc.)

Thermometers

Products for pain & cramp relief

Wart removers

Products for muscle or joint pain

Special ointments or sunburn

creams

Topical creams

Health Care

flexible spending account

Non-eligible items

Cosmetics

Toiletries

Personal hygiene/care items

Items used to promote general health

& well being

Weight loss drugs

Eligible DCAP Expenses

The Dependent Care Assistance account

allows you to pay for

“eployet related

expenses

”

that enable you and your spouse

to be gainfully employed, seek employment,

and/or be a fulltime student. In general,

expenses must b

e for the “e” of a

qualifying individual. Reimbursement may

also include eligible expenses for children or

elder dependents that rely on you for their

care.

Some examples of eligible expenses include:

?

care in and outside the home

?

child-care/dependent care centers

?

before and after school care

?

nursery school and preschool expenses

?

preschool tuition

?

day care camps and facilities

(only

for “car

no

e”

t p

a

rim

d

arily for educational purposes)

Expenses for services provided outside the

employee’s

a

h

d

o

ep

me

enden

y

t care centers

must comply with state and local laws. Your care

provider must report day care income on their

taxes to be considered as eligible.

Dependent Care FSA must be for children under

13 years of age, unless they meet the

qualifications of physically or mentally incapable

of self-care.

Dependent Care

flexible spending account

Ineligible Expenses

The following items are examples of expenses that are generally considered as ineligible

for reimbursement under a Dependent Care FSA:

?

Educational expenses, except where an eligible child is in preschool or

nursery school

?

Field trips, clothing

?

Late payment or finance charges

?

Payments for lessons

?

Tuition expenses

?

Overnight camps

?

Kindergarten expenses

DCAP Reimbursements

The total amount you choose to contribute should be based on your expected child

and/or dependent care expenses during the plan year. A single parent, or employee that

is married but filing separately is limited to $2,500 for the Plan year. If your spouse has a

dependent care account through their employment, the two accounts cannot exceed

$5,000 during a given plan year.

IRS guidelines require that the amount reimbursed to a participant must first be on

deposit in their account. When your employer submits payroll funds to MGM Benefits

Group, they are credited to your dependent care account. When a claim is filed for

reimbursement, we first verify that there are adequate funds in the account to pay the

entire claim. When sufficient funds are not available, participants are issued the

maximum amount available in their account. The remainder of the reimbursement

request is paid when additional funds are received through payroll deposits.

Dependent Care

flexible spending account

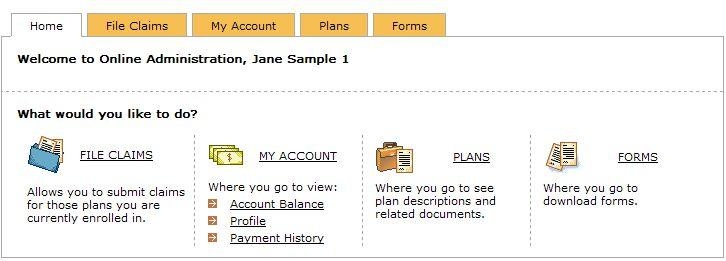

Website Access

Our new MGM Flex system offers participants the ability to manage their own account information.

On our new site, you can:

?

Create your own password

?

Access your account information by provider name, date and amount

?

File your claims online

?

Create your own direct deposit accounts

Once your enrollment in the Section 125 has been processed, you will receive an enrollment

confirmation, along with an attached

docu etitled “Next Steps”. Dowload this docu fro

your email for instructions on setting up your participant portal and to access account options.

Follow these steps to create your Participant Portal

:

1. Open your web browser (e.g. MS Explorer) and go to the following website:

http://mgmflex.com

2. Click on the participants Login. Both the username and password were sent to you via email

with your enrollment confirmation.

3. The login for your username is:

?

The first initial of your first name

?

Your last name

?

The last 4 digits of your social security number

Example username: jdoe9999

(Be sure and not use spaces or commas)

4. The password is your last name and the last four digits of your social security number

Example password: doe9999

You will be prompted to create your own password (6 to 20 upper and lower characters with at least

one number). If you forget or lose your password, you will need to reset it through the system. Pleas

e

be sure to record your password as MGM does not have access. If your password is lost or forgotten,

you will need to re-set it on your participant portal.

Participant Portal

website account

Sign in to your participant portal with your user name and password that you created for

your account.

My Account:

You can view up-to-date account information at any time.

?

Choose

Account Balance

to check the balances of any account. You can also check the claims history of any

account by clicking the

Claims History

link.

?

Select

Profile

to reie your persoal ad depee iforatio that’s o file i the syste.

?

Select

Payment History

to see a detail of the claims that have been paid. You can click

View Detail

for more

information about any claim.

File Claims

: You now have the option to file your claims online.

Plans:

Your Pre-tax plan information is available at any time. To view this information, log on and click on

the

Plans

tab.

Forms:

You can download Pre-tax forms at any time. Log on and click on the

Forms

tab, and select the

form you would like to download.

Participant Portal

Account View

You Have Options!

You may file your claims by one of the following methods:

1. If your employer offers the MGM Flex Visa Card

: you may use your Card at the point of

purchase towards qualified expenses.

Be sure to keep your receipts!

You may be required to

submit them as proof of plan eligibility!

2. Online Claim Filing

: File your claims online via our participant portal website. Instructions were

attached to your enrollment confirmation

o the “et Steps” d

B

o

e s

u

ure to submit

receipts when filing claims online by fax or mail.

If you do not submit your claims and receipts

after filing online, you will be sent a reminder to submit the information. Claims will be denied

after a period of 14 consecutive days.

3. Paper Claim Filing

: You may also file claims using the paper form(s) available on the website

ude the “Fo” ta, ad attaR euied eipts aodig to IRS ules.

Reminders:

Health Care Flexible Spending Claims:

?

Your account balance is available for use on the first day of the plan year

?

Funds remaining in your account that have not been spent, will be subject to the

“use it or lose it rules”

?

Based o ou Eploe s Pla les, ou ill hae a speified tie peiod follog the last da of ou

plan year to request reimbursement for expenses incurred, but not claimed, during the plan year

?

Some health care items may be eligible

only

if you are diagnosed by a medical professional for a

specified medical condition. For these expenses, you will be asked to provide a copy of diagnosis and

treatment from your physician.

No matter which option that you may choose for claim reimbursement, always be sure to keep your

receipts.

Dependent Care Flexible Spending Claims:

?

The MGM Flex Card does not accept charges for dependent care related expenses

?

Claims may be filed by

Pape o “aual”

s

l

or

ai

online through the Participant Portal website

?

Funds must be available in dependent care accounts prior to reimbursement. IRS regulations do not

allow pre-funding of DCAP accounts.

How to File Claims

The MGM Flex Card

The MGM Flex Card makes using your Health FSA quick and easy. Just

swipe it as payment for your eligible expenses and the funds are

automatically deducted from your account

If your Employer offers the MGM Flex Card

, it is an

automatic way to pay for qualified health care expenses.

It is not a credit card, but can be used to pay for your

eligible health flexible spending account (FSA) purchases.

The card is similar to a Visa Card, and the value of the

partii

an

p

n

a

ual

t’

c

s

ontribution is loaded on it. The

amount of the qualified purchases will be automatically

deducted from the account.

The Card may be used for eligible flexible spending account (FSA) expenses as determined by Section 213(d) of

the Internal Revenue code. You may use the Card for co-pays at hospitals, physician offices, dental offices, vision

service locations and pharmacies, wherever they accept MasterCard

®

or Visa

®

debit cards for purchases.

Only

eligible expenses that have been incurred during the current plan year and/or grace period can be claimed as

eligible expenses.

O

er the outer produts (OTC’s) are eli

, b

g

ut

i

th

l

e

e

item

t

s

op

must

u

be

r

u

h

sed

ase

for trea

t

ti

h

ng

the Card

symptoms of injury and illness. Examples include: cold and allergy remedies, first aid supplies, pain remedies,

etc. Personal care items are not eligible for Card use.

Here’s ho it ks:

?

Take your purchases to the register

?

Preset our MM e Card for pae ad selet the optio for “redit”

?

The system will identify eligible

ard purhase (presriptios ad OTC’s)

?

Pay for your non-eligible items separately with another form of payment

?

If the purchase is approved, the amount will be deducted from your card account balance.

You can also fill in your Card number on health related bills received from providers to pay on your account

balance.

The card cannot be used to pay expenses that were incurred prior to your current Section 125 Plan

year.

Be sure and save all receipts for purchases made with the MGM Flex Card

Introducing . . .

the MGM Visa Card

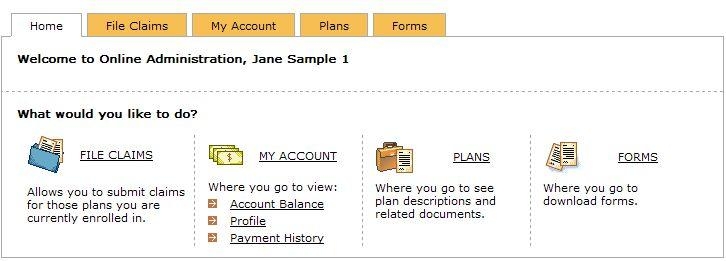

Claims

Logon to www.mgmflex.com

1. Click the

File Claims

tab.

2. Click the

File Claim

button next to the plan you wish to file a claim for.

Online Claim Filing

Participant Login

Home Page

3.

Enter your claim information and submit the claim. Make sure you have valid receipt(s)

for your expenses, as you will need to send these in.

4.

If you have re tha oe clai you’d lik

Ad

e

d a

t

New

o f

Cl

i

aim

le, you choose to

from your claim basket.

5.

Once all claims are entered, you must agree to the

Terms & Conditions

and submit

the claim.

Online Claim Filing

continued

6.

Print the

Confirmation Page

. This is your verification that all claims have been successfully submitted!

7.

Attach the Confirmation Page with a copy of your receipt; fax or mail to MGM for processing.

Fax Number:

(800) 973- 3702

Mailing Address:

MGM Flex

2121 N. Glenville Drive

Richardson, TX 75082

Online Claim Filing

continued

Claim forms for Health flexible spending accounts and Dependent Care flexible

spending accounts may be downloaded from the participant portal. Click the Forms

tab and choose the applicable form for your expense.

?

Complete the correct reimbursement claim form

?

Submit an Explanation of Benefits (EOB) or your eligible receipts

?

Make copies of your receipts and EOB

?

Do not send your original receipts, but retain originals for your records

?

An eligible receipt will have the following:

o

Provider name

o

Date of service

o

Description of service

o

Payment amount

o

Sales repts ith totals “oly” are ot

acceptable based on IRS guidelines

?

Submit your claim form and receipts by fax or mail to the address on the form

?

Paper claims are processed and checks issued within 72 hours (on business days) after receipt of

claims

Dependent Care Claims:

Depedet Care lai ill oly e reiursed ased o the fuds aailale i the partiipat’s

account. Claims will not be pre-funded. For claims submitted that exceed the account balance,

funds will be reimbursed as they are deposited to the account.

Manual Claim Filing